Paper clutter can build up quickly, and it’s easy to hold on to documents longer than you need to. Knowing what papers you can safely toss helps you keep things organized without risking your personal information.

You can protect your identity and free up space by shredding outdated documents that no longer serve a purpose. This article will help you figure out which papers are safe to shred so you can clear out your files with confidence.

Old junk mail

You get a lot of junk mail, and most of it doesn’t need to stick around. If it has your name, address, or other personal info, it’s a good idea to shred it.

This helps keep your info safe and cuts down on clutter. Even if it looks harmless, shredding junk mail with your details is a smart move.

Expired coupons

You probably have coupons lying around that are past their expiration date. These don’t do you any good and just add clutter.

Throwing them away or shredding them is an easy way to clear space. Plus, it helps protect any personal info that might be on the coupons.

Medical prescription labels

You should shred your old medical prescription labels. They often have personal info like your name and the medicine you took.

Leaving them out could let someone see your private health details.

So, when you toss old medicine bottles, remove and shred the labels if you can. It’s a simple step to protect your privacy.

Outdated travel itineraries

You can shred old travel itineraries once your trip is over. They usually have no value after you return.

Keeping them just takes up space and might include personal info you don’t want lying around. If you want to keep proof of travel, save digital copies instead. This way, you stay organized and protect your data.

Shipping labels from delivered packages

You should peel off shipping labels from packages before tossing the boxes. These labels often have your address and other personal info.

To keep your info safe, stick labels onto paper and then shred them. This is an easy way to prevent someone from seeing your details.

Used memos and sticky notes

You probably keep a lot of memos and sticky notes around. Once you’re done with them, it’s safe to shred them.

These papers often have personal or work details you don’t want others to see. Shredding keeps your information private and helps clear up clutter.

Resumes from past jobs

You can usually get rid of resumes from jobs you had more than two years ago. After that time, they don’t hold much value.

Keeping them longer won’t help much unless you’re still applying for similar roles. Shredding old resumes also protects your personal info from falling into the wrong hands.

Old tax documents (over 7 years)

You can shred old tax documents that are more than seven years old. The IRS usually only goes back six or seven years to check returns.

Keep anything related to audits or claims longer than that. But if you don’t have any issues, those old papers just take up space and can be safely shredded.

Utility bills older than 2 years

You can safely shred utility bills that are more than two years old. These papers usually don’t hold much value after that time.

Keeping recent bills is helpful for tracking your spending or handling disputes. But after two years, they just take up space. Make sure they don’t contain any personal info you might need before tossing them. Shredding them protects your privacy.

ATM and sales receipts older than 1 year

You can usually toss ATM and sales receipts that are more than a year old.

If you don’t need them for returns or taxes, they don’t hold much value after that time. Keeping them longer just adds clutter. Shred them to protect your info and free up space.

Expired warranties

You can shred expired warranties once they are no longer valid. These papers usually don’t have any value after the warranty period ends. Just make sure they don’t have personal information like your address or account numbers before tossing them. Shredding them helps keep your info safe and clears up clutter.

Old bank statements (over 7 years)

You can usually shred bank statements that are more than 7 years old. Banks don’t need you to keep them after that time since they keep their own records.

If you think you might need them for taxes or disputes, hold on to the recent ones. Otherwise, shredding old statements helps protect your personal info from theft.

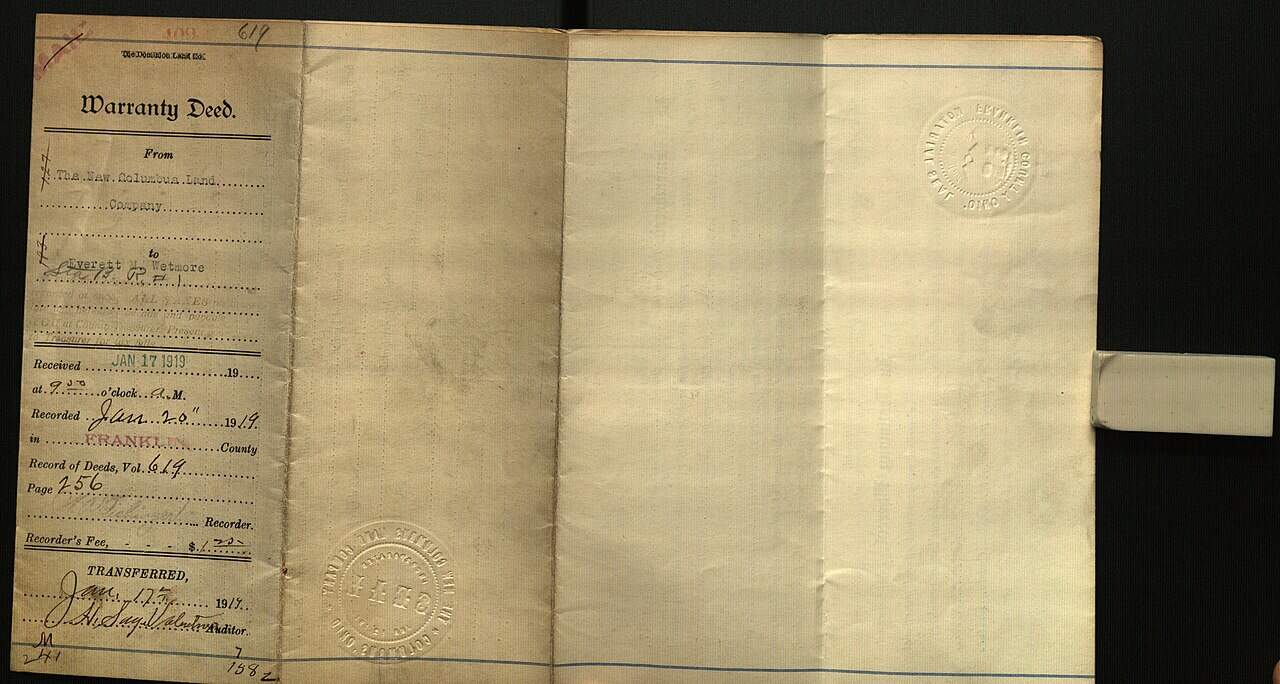

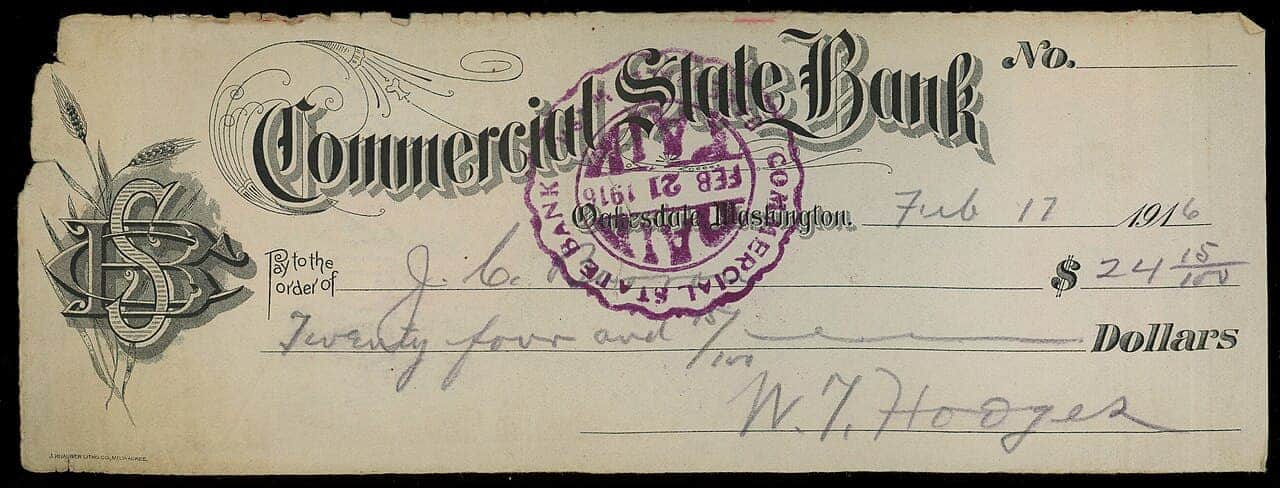

Cancelled checks older than 7 years

You can safely shred cancelled checks that are more than 7 years old. They usually hold no legal value after that time.

Keep them if you think you might need proof for taxes or disputes. Otherwise, shredding helps protect your personal info like bank details.

Old insurance policies

You can shred insurance policies that are no longer active. Keep the ones you need for current coverage or claims, but old ones usually aren’t useful.

Make sure to save a copy if you think you might need proof later. Otherwise, shredding old policies helps keep your documents organized and safe from identity theft.

Expired gift cards

You should shred expired gift cards you no longer plan to use. They contain personal information and codes that could be stolen.

Just cut them into small pieces so no one can reuse them. This keeps your info safe and your old stuff clutter-free.

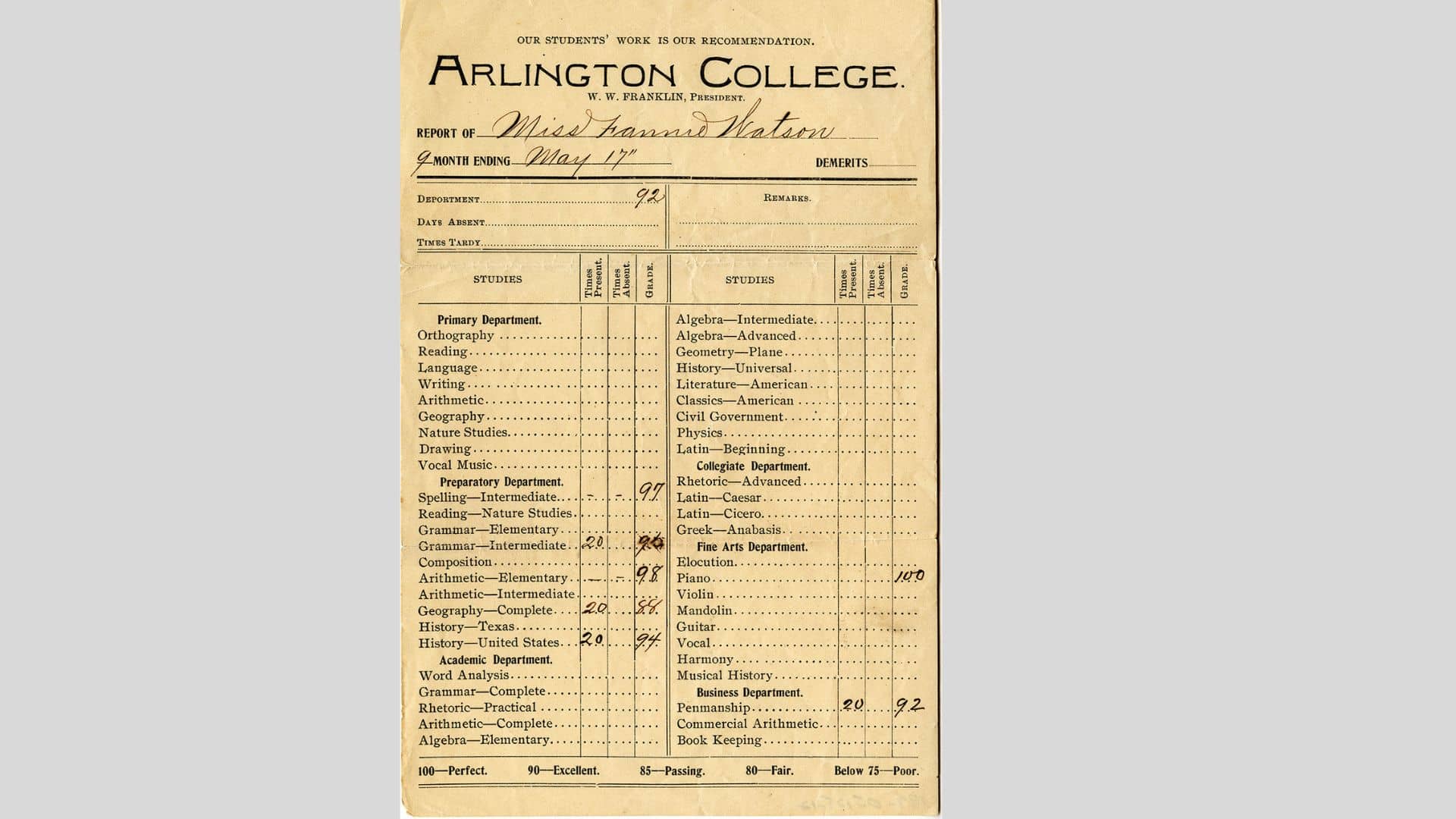

Old schoolwork and report cards

You don’t need to keep every paper from school. Old worksheets, notebooks, and assignments can usually be shredded once you’re done with them.

Report cards from many years ago can also be tossed, especially if you have newer ones or a copy saved digitally. Keep only a few important ones if you want to look back on them later.

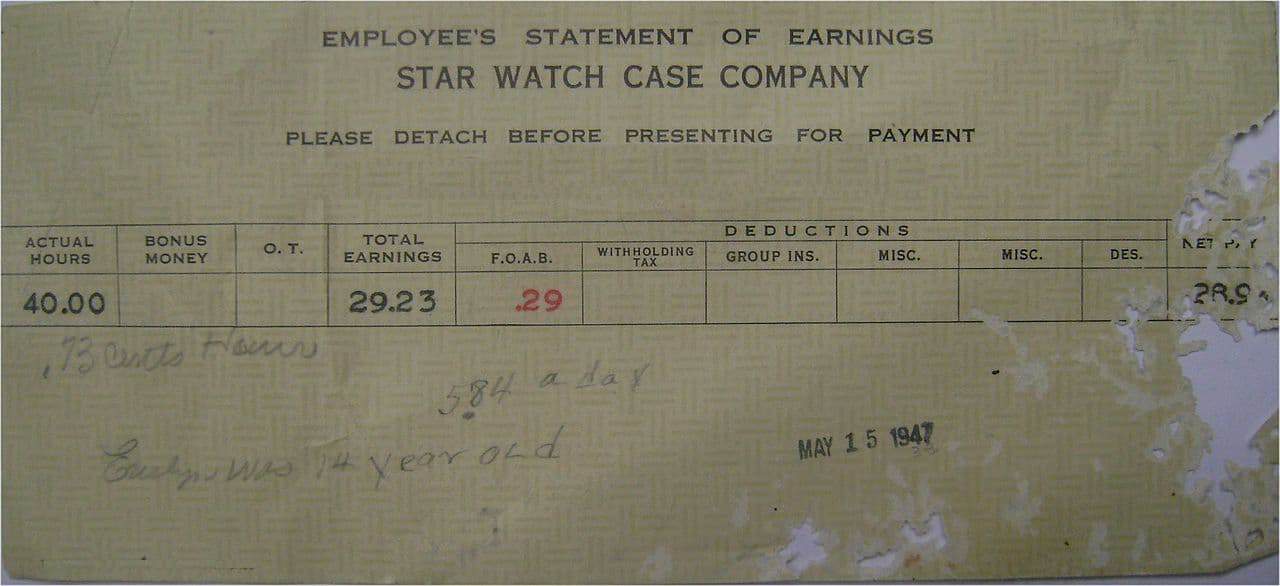

Pay stubs older than 1 year

You don’t need to keep pay stubs for more than a year. After that, they usually don’t serve much purpose.

Make sure your pay stubs match your W-2 tax form before you shred them. If you ever need proof of income, your W-2 form is the key document to keep, not old pay stubs.